Is cryptocurrency bad for climate change?

We know that both crypto and tokens have as many supporters as opponents. We will focus solely on presenting how their mining affects the climate and what, if anything, can be done to make it as environmentally friendly as possible. From this article you’ll learn:

How is it possible that Bitcoins consume so much energy?

Are cryptocurrencies bad for the climate by definition?

How to count the carbon footprint of cryptocurrencies / NFT?

Table of Contents

What is cryptocurrency?

A cryptocurrency is a digital or virtual currency secured by cryptography, making it nearly impossible to counterfeit or double-spend.

Some of us love them, others hate them, and others haven’t heard of them. Before we go any further, let’s give some explanations.

Cryptocurrencies are also decentralized, which means that any government or financial institution does not control them. This can make them less vulnerable to fraud or manipulation.

That being said, it is important to note that cryptocurrencies are not completely immune to risks. For example, the value of a cryptocurrency can fluctuate wildly, and there have been cyberattacks on cryptocurrency exchanges in which hackers have stolen vast amounts of digital currency. It is also important to use a secure digital wallet to store your cryptocurrency and to practice good security hygiene to protect your digital assets.

The pros and cons of crypto

The advantages of cryptocurrencies include cheaper and faster money transfers and decentralized systems that do not collapse at a single point of failure.

The disadvantages of cryptocurrencies include their price volatility, high energy consumption for mining activities, and use in criminal activities.

What is blockchain technology

Blockchain is a distributed database or ledger shared among a computer network’s nodes. As a database, a blockchain stores information electronically in a digital format.

Decentralized blockchains are immutable, which means that the data entered is irreversible. For Bitcoin, transactions are permanently recorded and viewable to anyone.

What are the 4 different types of blockchain technology?

There are several types of blockchain technology, and the specific categorization can vary depending on the criteria used. Here are four broad categories that are commonly recognized:

Public blockchains are decentralized networks open to anyone and secured using cryptography. They allow anyone to participate in the network, read or write data to the blockchain, and verify transactions. Examples include the Bitcoin and Ethereum networks.

Private blockchains are centralized networks restricted to authorized participants and are typically used by organizations for internal record-keeping and other purposes. They offer more control over who can access the network and what can be recorded on the blockchain, but they also raise concerns about security and decentralization.

Hybrid blockchains: These are networks that combine features of both public and private blockchains, allowing for a degree of customization and flexibility. They can be used to balance the security and transparency of public blockchains and the control and privacy of private blockchains.

Sidechains are separate blockchain networks connected to the main blockchain and can be used to perform specific functions or experiment with new technologies. They allow for the transfer of assets or data between the main blockchain and the sidechain and can be used to scale the main blockchain or to test new features before they are implemented on the main chain.

What exactly is NFT?

NFT – Non-fungible tokens (NFTs) are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other.

They are something like a certificate of authenticity. NFT tokens are not exchangeable in any way and are the digital property of the holder. They also cannot be copied. NFTs can represent real-world objects such as artwork or real estate.

What is bitcoin mining?

Bitcoin is a decentralized digital currency that uses cryptography for security and is not controlled by any government or financial institution. It was created in 2009 by an unknown individual or group of individuals using the pseudonym “Satoshi Nakamoto.”

Bitcoin operates on a decentralized, peer-to-peer network called the blockchain, which allows users to send and receive bitcoins without intermediaries. Transactions on the Bitcoin network are recorded on a public ledger called the blockchain, which helps ensure the network’s integrity and security.

Users can buy and sell bitcoins using exchanges. They can also earn bitcoins by participating in the network as “miners,” which involves using specialized hardware to validate transactions and add them to the blockchain.

Bitcoin has gained significant attention and adoption since its inception, and it is often considered the first and most well-known cryptocurrency. However, it has also faced controversy and regulatory challenges, and its value has fluctuated significantly over time.

Where did bitcoin come from?

It is widely believed that bitcoin was the first of the cryptocurrencies, although similar solutions have existed since the 1990s.

It is not known who created bitcoin. All that is known is that it was a programmer or group of programmers nicknamed Satoshi Nakamoto. It was created in early 2009, right after the outbreak of the global economic crisis.

The crisis at that time strongly undermined the trust in governments and central banks, responsible for creating a bubble in the real estate market and the subsequent massive printing of money. As an act of defiance, a currency with a limited supply in advance (21 million BTC in circulation) was created, which was supposed to enable fast, safe, and cheap payments without any intermediaries and, at the same time remain outside the control of governments and financial institutions.

Ethereum, litecoin, and ripple

Apart from bitcoin, there are other cryptocurrencies. The oldest and most important include Ethereum, litecoin, and ripple. Currently, there are already several thousand virtual currencies and tokens.

How much greenhouse gas emissions come from crypto?

You probably already know that every online action generates CO2 emissions – a digital carbon footprint. It is no different with cryptocurrencies and NFTs – although they have no physical dimension but a digital one, they generate a high carbon footprint.

According to a study by the Central Bank of the Netherlands, a single transaction using cryptocurrencies such as bitcoin involves the emission of approx. 402 kg of carbon dioxide. The average household emits the same amount of CO2 for three weeks.

Is that a lot? Yes, it is a lot. But nothing is zero-sum.

How is cryptocurrency affecting the environment?

This is all because of the gigantic consumption of electricity.

The world still mostly uses fossil fuels such as coal, oil, and gas for energy production, and combustion emissions are the main component of the carbon footprint of cryptocurrencies.

It is worth mentioning right away that many “mines” today are powered by renewable energy sources.

The energy consumption is so high that if Bitcoin alone were a country, it would consume more energy annually than Belgium, Finland, or the Philippines. It accounts for 60% of Poland’s energy consumption.

Where does this electricity consumption come from?

Conceptually, it seems that Bitcoin should not require huge amounts of electricity. You only have to click or tap on your smartphone to buy and sell cryptocurrency. We have had the technology to do the same for other digital transactions for decades.

But Bitcoin’s decentralized structure drives its huge carbon emissions footprint.

Bitcoin requires computers to solve ever more complex math problems to verify transactions. This proof-of-work consensus mechanism is drastically more energy-intensive than many people realize.

Cryptocurrency “miners” seek results in an algorithmic puzzle that fits specific requirements. Miners are obliged to keep upgrading to earn rewards as fast as competitors. And more computing power requires more electricity.

Bitcoin energy comparison by country

Comparing Bitcoin’s energy consumption to that of entire countries can be challenging because the two are measured in different units. Bitcoin’s energy consumption is typically measured in terawatt hours (TWh). In contrast, a country’s energy consumption is measured in terms of total or electricity consumption in gigawatt hours (GWh). However, we can make some rough comparisons based on available data.

Here are some rough comparisons of Bitcoin’s energy consumption to that of various countries:

In 2021, Bitcoin’s estimated annual energy consumption was around 121 TWh, more than that of countries like Argentina, Sweden, and Malaysia.

In 2020, Bitcoin’s estimated annual energy consumption was around 67 TWh, roughly equivalent to the energy consumption of the entire country of Austria.

It’s worth noting that these comparisons are rough and should be taken with a grain of salt. Bitcoin’s energy consumption is constantly changing, as is countries’ energy consumption. Additionally, Bitcoin’s energy consumption is distributed worldwide, while a country’s energy consumption is centralized within its borders.

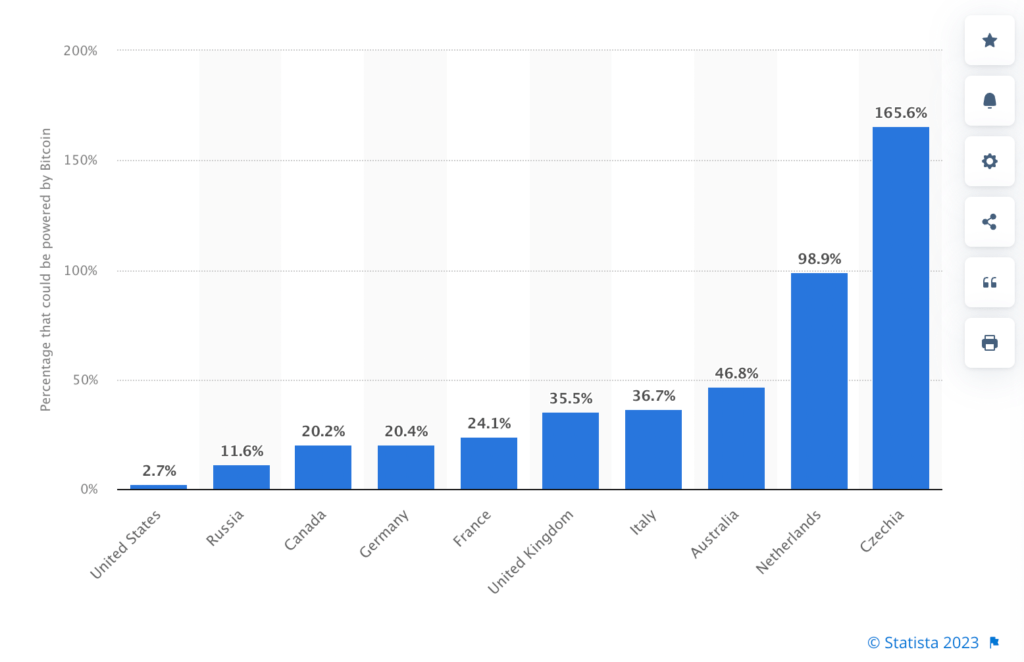

Below, you may see the energy consumption from Bitcoin compared to the total energy consumption in selected countries worldwide as of November 18, 2022

Can Bitcoin be environmentally friendly?

Bitcoin’s current proof-of-work (PoW) consensus algorithm is not environmentally friendly, as it requires a large amount of computational power and energy consumption to secure the network and process transactions. However, there are some ways that Bitcoin could potentially become more environmentally friendly in the future.

Transition to proof-of-stake (PoS): One option for making Bitcoin more environmentally friendly is to transition from PoW to a PoS consensus algorithm. PoS requires much less computational power and energy consumption than PoW, which would significantly reduce Bitcoin’s environmental impact.

Increased use of renewable energy: Another option is to increase the use of renewable energy sources for Bitcoin mining. Currently, a significant amount of Bitcoin mining uses fossil fuels, contributing to carbon emissions. Using renewable energy sources like solar or wind power could reduce the environmental impact of Bitcoin mining.

Improved mining efficiency: Another option is improving Bitcoin mining hardware and software efficiency. This could be achieved by developing more energy-efficient mining hardware or optimizing the mining software algorithms.

Offset carbon emissions: Some companies and organizations are exploring the possibility of offsetting the carbon emissions associated with Bitcoin mining through carbon credits or other mechanisms. While this does not reduce the actual energy consumption of Bitcoin mining, it can help to mitigate the environmental impact of Bitcoin.

While Bitcoin’s current PoW consensus algorithm is not environmentally friendly, some potential options exist for making it more sustainable. However, it is important to note that transitioning to a more environmentally friendly consensus algorithm or increasing renewable energy sources will require significant investment and effort from the Bitcoin community.

How does crypto hurt the planet?

Below is the diagram are the values that a single Bitcoin transaction generates – carbon footprint, electricity, and electronic waste.

First and foremost, it is important to pay attention, if only to where the excavators are located. Server rooms in places powered by alternative energy sources generate a much smaller carbon footprint than those with their servers in fossil fuel-powered areas.

However, other digging technologies are not based on proof of work, only proof of stake that is far less carbon-intensive. How are they different? We already explain:

PoS selects random validators to verify transactions, they can’t do it all at once. Instead of using computing power to solve the problem, the POS system uses a “share” of the currency No expensive hardware is required. As a result, energy consumption is much lower, which is more environmentally friendly.

Why are NFTs so popular now?

The history of purchases related to NFT tokens dates back to 2017. The world went crazy for NFT, and in 2021 we could see a real boom in their purchases. The desire to own something unique is so great that various industries are taking advantage of it. There are many possibilities for art, entertainment, music, and virtual real estate.

NFT is a virtual collectible value, a certificate of authenticity that can be treated as an investment. The token is just a digital creation – so the person buying the NFT does not receive the copyright to the asset (this, of course, depends on the specific item).

The non-convertibility of such a thing with a certificate should be understood as the absence of a counterpart or mass equivalent. Bitcoin from bitcoin is no different, they have a certain same value. They are exchangeable. NFTs are subject to trade and investment mechanisms, but are more of a collectible value than money.

How to calculate crypto or NFT carbon footprint?

Calculating the carbon footprint of cryptocurrencies and NFT is complicated but not impossible – the sources above point to specific numbers, after all. The calculation itself resembles the calculation of the digital carbon footprint, considering the location, type of fuel, ways to cool the server room, and type of equipment. However, there is no uniform methodology for calculating the digital carbon footprint or crypto/NFT together.

The world is changing before our eyes, blockchain technologies are gaining popularity month by month. Today we know that Cryptocurrencies and NFTs do not have to be the enemy of the planet. The choice of tech, in this case, is of great importance.

At Plan Be Eco, we have a deep sense that if we can measure something, we can change it. That's why we're working with organizations developing blockchain-based projects, and we hope that in the near future, the carbon footprint will become a factor in deciding what cryptocurrencies or tokens we invest in.

Joanna Maraszek, Head of product, Plan Be Eco

Why do NFTs have a carbon footprint?

As an analogy to cryptocurrencies, the climate impact of NFTs is whether they are on-chain in a proof of work or proof of stake algorithm.

See, for example, what makes up the carbon footprint of NFTs issued on Ethereum:

Minting: 142 kWh, 83 KgCO2

Bids: 41 kWh, 24 KgCO2

Cancel Bid: 12 kWh, 7 KgCO2

Sale: 87 kWh, 51 KgCO2

Transfer of ownership: 52 kWh, 30 KgCO2

A single NFT release is:

energy consumption of 340kWh

emissions equal to 211kg CO2

This is the equivalent of the following:

2 hours flying on a plane

driving 1,000 kilometers on petrol

working on a laptop for 3 years

For comparison: an NFT transaction on a proof of stake algorithm is 2.5g CO2 e (compared to 30 kg (30,000g) CO2e on Ethereum).

Ethereum 2.0 PoS transition

Ethereum is transitioning from a proof-of-work (PoW) consensus algorithm to a proof-of-stake (PoS) consensus algorithm. This transition is known as Ethereum 2.0 or Eth2.

The main motivation behind this transition is to address some of the scalability and energy efficiency issues with the PoW algorithm. PoW requires a lot of computational power to secure the network and process transactions, which consumes a lot of energy. PoS, on the other hand, uses a different mechanism to secure the network and process transactions that do not require the same level of computational power and energy consumption.

Here are some key aspects of the Ethereum 2.0 PoS transition:

Validator nodes: Ethereum 2.0 use validator nodes instead of miners to validate transactions and create new blocks. These validator nodes are responsible for staking a certain amount of ether (ETH) as collateral to participate in the network and earn rewards.

Randomized selection: Validator nodes are randomly selected to propose blocks and validate transactions. This helps prevent any validator node from gaining too much power or control over the network.

Staking rewards: Validator nodes earn rewards for participating in the network and validating transactions. These rewards are paid out in ETH.

Phased rollout: The transition to Ethereum 2.0 is being done in phases. The first phase, the Beacon Chain, was launched in December 2020. This phase introduced the PoS consensus algorithm and laid the groundwork for future upgrades.

Migration of existing ETH: As part of the transition, existing ETH will need to be migrated from the old PoW chain to the new PoS chain. This will be done through a process known as the Ethereum 2.0 merge.

Overall, the transition to a PoS consensus algorithm is expected to improve the scalability and energy efficiency of the Ethereum network while also providing new opportunities for staking and earning rewards for participants.

Which crypto has the lowest carbon footprint?

The environmental impact of cryptocurrencies, particularly those that use the proof-of-work (PoW) consensus algorithm like Bitcoin, has been a concern for many people. PoW algorithms require a lot of computational power to process transactions and secure the network, which consumes a significant amount of energy and contributes to carbon emissions. However, some cryptocurrencies use alternative consensus algorithms that are more environmentally friendly. Here are some examples:

Cardano (ADA): Cardano uses a proof-of-stake (PoS) consensus algorithm, which requires much less computational power and energy consumption than PoW. As a result, the energy consumption and environmental impact of Cardano are much lower than Bitcoin and other PoW-based cryptocurrencies.

Algorand (ALGO): Algorand uses a unique consensus algorithm, Pure Proof-of-Stake (PPoS), designed to be energy-efficient and secure. PPoS allows for fast transaction processing and low energy consumption, making Algorand an environmentally friendly cryptocurrency.

Hedera Hashgraph (HBAR): Hedera Hashgraph uses a consensus algorithm called Hashgraph, which is also designed to be energy-efficient and secure. The Hashgraph algorithm is based on a directed acyclic graph (DAG) and uses a voting mechanism to reach a consensus. This allows for fast transaction processing and low energy consumption.

Chia (XCH): Chia is a cryptocurrency that uses a consensus algorithm called Proof-of-Space-and-Time (PoST), designed to be more energy-efficient than PoW. PoST uses hard drive space rather than computational power to secure the network, which makes it more accessible and less energy-intensive.

Nano (NANO): Nano uses a consensus algorithm called Open Representative Voting (ORV), a variant of PoS. ORV allows for fast transaction processing and low energy consumption, making Nano an environmentally friendly cryptocurrency.

Overall, several cryptocurrencies use alternative, environmentally friendly consensus algorithms than PoW-based cryptocurrencies like Bitcoin. These cryptocurrencies offer a promising alternative for those who are concerned about the environmental impact of cryptocurrencies.

The impact of cryptocurrencies and tokens on the planet is undeniable. While China, for example, has banned cryptocurrency digging altogether, there’s no fooling yourself – virtual currencies aren’t going to evaporate. They will stay with us, perhaps becoming more common than they are now. It’s worth considering investments with the least possible impact on the climate or those that openly outline their reduction plans.