Carbon tax & CBAM: New challenges for the economy, and environment

The Carbon Border Adjustment Mechanism (CBAM) was introduced in response to increasing pressure to tackle greenhouse gas emissions and maintain industrial competitiveness in the European Union. The Carbon Border Adjustment Mechanism (CBAM) aims to protect the EU market from ‘carbon leakage’ – the relocation of production outside the EU to countries with less stringent climate regulations. So-called carbon leakage.

CBAM, the carbon border price adjustment mechanism, is a new instrument under the European Union’s climate policy that aims to level the international market playing field. It acts as a kind of carbon tax on goods imported into the EU whose production involves high greenhouse gas emissions. The mechanism is part of the European Union’s broader strategy known as ‘Fit for 55’, READY FOR 55? which aims to reduce CO2 emissions by 55% by 2030 from 1990 levels and achieve climate neutrality by 2050.

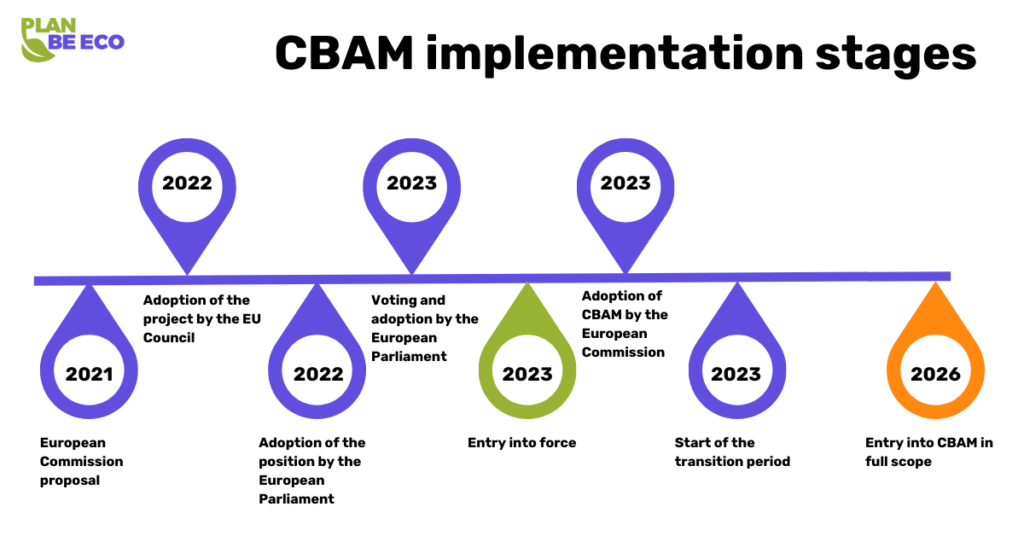

CBAM was introduced in a transitional phase in October 2023 and will be fully applicable from 01.01.2026. Until 2025, importers are only required to report the level of emissions associated with imported products, while from 2026 they will have to pay for CO2 emissions in accordance with EU emission rates (CSIS).

The CBAM mechanism operates under the EU Emissions Trading Scheme (EU ETS), which is one of the key instruments of EU climate policy. Companies from non-EU countries that export goods covered by the CBAM mechanism into the Union will have to pay the equivalent of the cost of the CO2 emissions, on a similar basis to EU ETS companies operating in the EU.

Under the European Parliament’s revised greenhouse gas emissions trading directive, the CBAM mechanism will initially cover materials such as iron and steel, cement, fertilisers, aluminium, hydrogen and electricity. These are the industries responsible for the largest CO2 emissions and are therefore a priority in the legislative process.

In order to determine whether an imported product is subject to the new CBAM rules, its CN code must be carefully checked. This code, found in box 33 of the customs declaration (SAD), uniquely identifies the product. The CN code should be compared with the list of products covered by CBAM. If the first four digits of the product’s CN code match the code in the CBAM list, the product is most likely covered by the new legislation. In case of doubt, it is advisable to consult an expert or to contact the customs authorities directly.

The CBAM primarily affects companies outside the European Union and the European Economic Area that export products covered by the mechanism to the EU. These companies will have to pay a ‘carbon tax’ for CO2 emissions resulting from the production process. The mechanism will also cover EU countries that import goods from third countries.

If the importer is not based in the EU, his or her responsibilities can be taken over by a customs agency, acting either as a direct or indirect representative of the importer who is based in the EU. The report can also be submitted by ESG, environmental, tax law firms that serve their clients in terms of CBAM.

The report must be filed quarterly, by the end of the month following the quarter for which the report is filed (example: the report for Q1 – January-March must be filed by 30 April). The company has a further 3 months to submit any corrections (according to the example we gave with Q1, this would be 31 July).

Lack of or errors in CBAM reporting can lead to serious financial and reputational consequences for the company. This is why it is so important to be thoroughly familiar with the applicable regulations and to file correct reports in a timely manner. If in doubt, it is advisable to consult an expert in customs or environmental law.

It is worth keeping up to date with any changes in CBAM regulations, as these may affect reporting obligations and penalties.

The introduction of the CBAM mechanism means a reduction in the number of free ETS allowances for EU companies, which is expected to further tighten the EU’s climate policy and otherwise reduce CO2 emissions. On the other hand, the CBAM carbon tax may increase production costs in non-EU countries, which in turn may lead to higher prices for imported products.

CBAM is a primarily fiscal instrument that is intended not only to influence climate protection, but also to protect EU companies from unfair competition from countries without strict greenhouse gas emission regulations. The EU aims to make the introduction of CBAM compatible with international trade rules, as well as a tool to support global efforts to reduce emissions.

The mechanism is important for both the economy and EU climate policy. CBAM is expected to cover up to 50% of the emissions covered by the ETS. For countries outside the EU that export to Europe, CBAM provides an additional incentive to put in place climate policies comparable to those of the EU, which can have a positive impact on global GHG emission reductions (EU Trade).

Economically, CBAM has the potential to generate significant revenues that can be used to further climate action in the EU. In contrast, for importers, especially from developing countries, the introduction of CBAM means an increase in production costs and may affect the competitiveness of their goods on the EU market (CSIS).

The carbon footprint is the basis for calculating the CBAM levy. This mechanism makes products with a high carbon footprint more expensive on the EU market, which in turn incentivises manufacturers to reduce emissions and switch to greener technologies. What do the two issues have in common?

A carbon tax in the form of the CBAM mechanism is an important step in EU climate policy, which aims not only to reduce CO2 emissions, but also to protect the EU market and ensure fair international competition. Both are a key element of the EU’s climate policy, which will affect changes at borders with greenhouse gas emissions and under the revised directive at borders with CO2 emissions.

If you are looking for trusted experts to support your company with ESG and CBAM reporting, we recommend our services. Plan Be Eco, in partnership with Green Reporting, provides a one-stop shop for businesses facing the challenge of reporting and planned decarbonisation. Get in touch to find out more about our detailed offering.

This article was written in collaboration with experts from Green Reporting. Attend a webinar about the carbon footprint and CBAM – click on the image below and register (webinar only in Polish).

The year 2026 marks a new stage in EU regulations. […]

Plan Be Eco Supplier – a comprehensive platform for decarbonization and […]

Transport and logistics (the TSL sector) have long been a […]