How to measure your portfolio carbon footprint? The carbon footprint in VC funds

Sustainability is becoming increasingly important around the world, and investors are increasingly directing their funds toward companies that conduct responsible business. Venture Capital (VC) funds are playing a crucial role in financing innovative ventures, and their contribution to transforming the economy into a greener one is becoming extremely important.

In this article, you’ll read why it’s a good idea for VC funds and lending institutions that provide investment advisory services to count the carbon footprint of their portfolio, by European Union guidelines, and what are the ways to calculate the carbon footprint for these entities.

Table of Contents

SFDR regulation in the context of greenhouse gas emissions

Entrepreneurs will already be bound by the CSRD (Corporate Sustainability Reporting Directive) starting in 2024, but in addition to this, there are additional ESG-related regulations for financial institutions. The SFDR (Sustainable Finance Disclosure Regulation), which went into effect in 2021, is an important step toward sustainability (investing) and a path for investors to follow. One aspect of SFDR is the requirement for companies that receive financing to report their carbon dioxide (CO2) emissions. This means that VC funds are now required to monitor and publish data on the carbon footprint of their portfolios.

The main goal of SFDR is to integrate sustainability risks into companies’ investment processes and report such integration at both the company and product levels.

Any company that offers and develops financial products must report the SFDR in addition to existing disclosure obligations regarding the financial liabilities of its products. While this mainly applies to companies operating in the EU, non-EU companies will be indirectly affected through their EU subsidiaries, the provision of services in the EU, and market pressures.

What are SFDR articles?

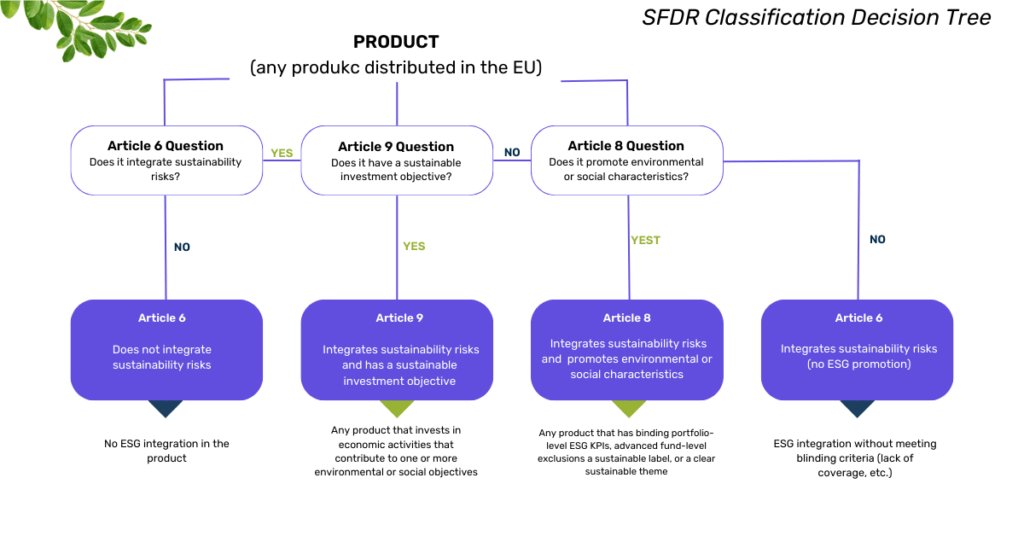

Under the SFDR, investment products are classified as one of the following articles:

Article 6 fund only considers sustainability risks or may not, and does not include any binding ESG (corporate governance, environmental and social responsibility) features.

Article 8 funds integrating ESG factors, considered to be more focused on financial materiality; not only takes into account sustainability risks but also promotes environmental or social features and applies good governance practices.

Article 9 funds focusing on sustainable economic activity or impact and/or aiming to reduce carbon footprint by the Paris Agreement.

The SFDR regulation and investment funds

The SFDR regulation is extremely important for investment funds for several key reasons:

It promotes sustainable investing, an approach to capital allocation that takes into account both financial, social, and environmental aspects. Investment funds can support companies that conduct responsible business and implement sustainability goals

The SFDR requires financial institutions to publish information on the environmental and social aspects of their investments. This makes investment funds more transparent and responsible, which in turn increases customer confidence in these institutions.

Incentivizing Innovation – companies that innovate in accordance with ESG gain in value, and investment funds investing in these companies can benefit from the increase in the value of their investments.

Investment funds that consider social and environmental responsibility can be more stable in a changing market environment.

Today’s investors are increasingly looking for investment opportunities that not only yield returns but also have a positive impact on the world. The SFDR helps to understand what companies face when working toward sustainability and to choose those that do not practice greenwashing.

The SFDR contributes to more sustainable and responsible investment portfolios and supports society’s transformation towards a more sustainable and ethical economy. For investment funds, this means meeting regulatory requirements, building trust, spurring innovation, and supporting long-term growth.

Why is carbon footprint calculation important for VC Funds?

The carbon footprint is created by human burning of fossil fuels. We calculate companies’ emissions in three scopes; the unit of carbon footprint is carbon dioxide equivalent.

Scope 1 is direct emissions resulting from the combustion of fuels in stationary or mobile sources owned or supervised by the company.

Scope 2 includes indirect emissions resulting from the consumption of imported electricity, heating and cooling, and process steam purchased by the organization.

Scope three includes all other emissions along the value chain not included in scopes one and two that occur outside the organization, including emissions at the production (upstream) and consumption (downstream emissions) levels.

Financed emissions are defined as Scope 3 emissions under the GHG Protocol, exactly category 15, but most financial institutions are unaware of their magnitude. Why? There are still very few companies reporting scope 3, which includes most of the company’s GHG emissions, thus missing the opportunity to effectively manage the carbon footprint.

Measuring carbon footprint is also putting pressure on invested entities, so they may have an incentive to take action to reduce their emissions. In addition, it is becoming increasingly common to require reporting of greenhouse gases emissions in the due diligence process – a practice that can significantly impact the industry’s emissions reductions.

How to calculate the carbon footprint of a VC investment fund (portfolio carbon emissions)?

Obtain the carbon footprint data of the companies you invest in. Ask them for a carbon footprint report (carbon emissions data), and note that emissions from all scopes are relevant. Learn more about Scope 3 in carbon footprint calculations here.

Add your Scope 1, 2, and 3 GHG emissions to calculate your portfolio’s total carbon footprint – this will be necessary for the next steps.

Next, you’ll need to calculate the ratio of the present value of your investment to the market capitalization (market cap) of the issuer in question. Only when this quotient is multiplied by the value of the carbon footprints ( scope 1, 2, and 3) you’ll get the total value of your portfolio’s emissions.

What does this knowledge give us? A portfolio’s carbon footprint allows you to measure your investment’s contribution to climate change. The relative carbon footprint is measured in total carbon emissions expressed in terms of invested currency. Greenhouse gas emissions cost money, and often not very much, so actions leading to a reduction in the carbon footprint will enable savings not only in environmental terms but also to a significant degree financially.

Are VCs ready to calculate their portfolio's carbon footprint?

The introduction of requirements for VC funds to count their portfolio’s carbon footprint can be a challenge, especially for those funds not previously required to monitor such data. However, given the growing importance of sustainability and pressure from the market and legislation, VC firms must prepare for the process.

While calculating an investment portfolio carbon footprint can be a challenge, it is inevitable for VC funds. Companies that manage to successfully implement these changes can not only meet the regulatory requirements but also gain a competitive advantage and attract interested parties in sustainable investing.

As the public becomes more aware of climate change, market pressures are increasing. Investors increasingly expect their funds to be invested with climate change considerations in mind. With the development of technology and increased knowledge of carbon footprint reporting, they are choosing to count their portfolio themselves. There are already tools and platforms that help companies assess and monitor the environmental impact of their investments. Such a tool is Plan Be Eco, a software that allows you to calculate your carbon footprint in all 3 scopes in accordance with greenhouse gas protocol.

Plan Be Eco's collaboration with an investment fund

Calculating the carbon footprint of the fund and its portfolio companies was obvious to the Polish fund Simpact Venture, which is one of the few venture capital funds with a “deep green” approach, according to which investments should not only generate financial returns but also have a positive impact on the environment and society.

- We are not looking for companies that "do no harm" or "have no negative impact" or, on occasion, impact an area of life or an issue. We care about those who create lasting and positive changes in society through innovative projects and decisive action. Hence, working with Plan Be Eco is a key step that will enable us not only to calculate our carbon footprint but also to develop a strategy for reducing our carbon footprint in the years to come. This aligns perfectly with our deep green approach and investment philosophy, pointing the way towards a more sustainable future

Krzysztof Grochowski, Managing Partner, Simpact Ventures. Tweet

Summary

The introduction of requirements showing how to calculate an organization’s carbon footprint by VC funds is not only a step towards sustainable investing but also a key response to the growing challenges of climate change.

The public’s awareness of green issues (such as renewable energy sources) and investors’ expectations of sustainable investments make monitoring CO2 emissions essential to remain competitive in the investment market. Tools such as Plan Be Eco offer investment funds the ability to meet European Union requirements for ESG reporting and carbon footprint calculations, which will give such companies a competitive advantage and the opportunity for effective climate action, emissions reduction, and net zero in the future.