What should every entrepreneur know about the CSRD?

The CSRD (Corporate Sustainability Reporting Directive) is a key step towards a more responsible and sustainable economy. For businesses, it means complying with new standards for reporting high-quality data and integrating sustainability into their business strategy.

That compliance not only benefits the environment but can also contribute to the long-term success and sustainability of businesses in the market. It will enable greater influence to be exerted on EU operators to work more effectively towards sustainability.

Read the article below and find out what the CSRD is and who the CSRD covers, why CSRD is important, and what does CSRD require.

Table of content

When and why was the CSRD adopted?

The introduction of the Corporate Sustainability Reporting Directive CSRD is a step towards a more coherent and rigorous approach to corporate sustainability reporting in the European Union, given the growing importance of sustainability issues in today’s world.

On 10 November 2022, the European Parliament, based on the Sustainable Development Act, passed the draft CSRD, which will replace the NFRD (Non-Financial Reporting Directive) that has been in force until now.

The reason for the European Commission’s introduction of the new directive is to standardize and raise the reporting standards of reporting entities due to the overly general nature of the previous disclosure provisions in non-financial reporting.

The NFRD vs. CSRD reporting requirements

The NFRD has certainly contributed to increasing the availability of ESG (environmental, social, and governance) information for companies in the European Union, but many stakeholders, including investors, have expressed concerns about the insufficient quality and difficulty in comparing the information made available by companies.

The reason was the lack of a common, given standard for sustainability reporting. In addition, it became necessary to align the requirements of the NFRD with new regulations subsequently introduced as part of the European Union’s Sustainable Finance Strategy, such as the EU Taxonomy and the SFDR (Sustainable Finance Disclosure Regulation – Regulation 2019/2088 on Sustainability Disclosures in the Financial Services Sector).

What should be reported under CSRD?

For consistent and credible reporting, the European Commission has adopted the European Sustainability Reporting Standards (ESRS) – the first of which was approved some time ago.

These standards cover the full range of environmental, social, and governance issues, including climate change, biodiversity, and human rights. They provide investors with information to understand the sustainability impact of the companies in which they invest.

Common standards are intended to help companies reduce reporting costs and prevent the use of voluntary standards, as is currently the case – as this generates problems with the quality of reporting. Only by harmonizing them will companies’ public reporting be credible.

So, what does CSRD require? Let’s check.

Businesses covered by the directive will have to publish information related to:

Environmental protection,

social responsibility and treatment of employees,

respect for human rights,

anti-corruption and anti-bribery,

diversity on company boards.

Which companies need to report on CSRD?

The CSRD will apply to each of the following entities:

All companies listed on a regulated market in the European Union, including small and medium-sized enterprises (excluding micro-enterprises).

All large companies meet at least two of the following three criteria (by the Accounting Directive 2013/34/EU):

– Number of employees exceeding 250 persons

– Net turnover exceeding Euro 36 million

– A balance sheet exceeding Euro 18 million

When did the CSRD come into force?

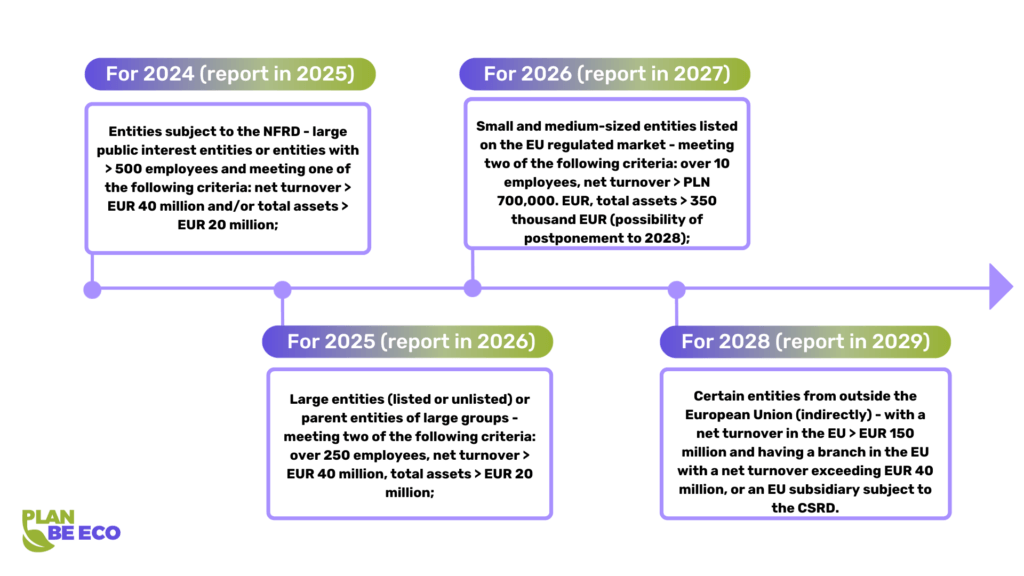

For 2024 (Reporting in 2025)

Entities that are subject to the NFRD – large public interest entities or entities with > 500 employees and that meet one of the following criteria: net turnover > EUR 40 min and/or total assets > EUR 20 million;

For 2025 (Reporting in 2026)

Large entities (listed or not) or parent entities of large groups – meeting two of the following criteria: more than 250 employees, net turnover> EUR 40 min, total assets > EUR 20 min;

For 2026 (Reporting in 2027)

Small and medium-sized EU-listed entities – meeting two of the following criteria: more than 10 employees, net turnover > EUR 700k, total assets > EUR 350k (postponable to 2028);

For 2028 (Reporting in 2029)

Certain non-EU entities (indirectly) – with an EU net turnover > EUR 150 million, and an EU branch with a net turnover of more than EUR 40 million, or an EU subsidiary subject to the CSRD.

How many companies are subject to the new CSRD directive?

Who is subject to the CSRD? In 2024, the number of companies subject to the CSRD in the European Union will increase by approximately 35%, and it is estimated that up to 50,000 will be affected. For Poland, this obligation will cover approximately 1,400 companies, which is 40% more than today.

It should be emphasized that from January 2024, not only companies with more than 500 employees, as indicated in the schedule above, but also smaller entities that are part of the supply chain of these large corporations will have to report.

The introduced CSRD introduces more comprehensive and detailed non-financial reporting requirements. The reporting obligation will be phased in gradually, and in the first phase, in 2024, will cover the largest companies, with a turnover of more than €750 million.

Non-EU companies and sustainability reporting

It is estimated that at least 10,000 foreign companies will be affected by EU sustainability rules. Non-EU companies doing business in the EU will be forced to report indirectly. The conditions for this reporting will be as follows:

Net turnover generated in the EU exceeding €150 million and at the same time a subsidiary in the EU that falls within the scope of the CSRD, or

A net turnover generated in the EU exceeding €150 million, and a branch in the EU with an annual net turnover exceeding €40 million.

CSRD vs. ESG - how does it compare?

The CSRD requires companies to report non-financial data on ESG areas, which obliges companies to collect and present information on their environmental, social, and governance impacts.

ESG reporting is crucial for several reasons. It enables companies to assess the environmental, social, and governance impacts of their activities. Secondly, it can be used by investors, customers, and other stakeholders to assess the potential risks associated with a company. Finally, it assists companies in building a reputation as socially and environmentally responsible actors.

The implementation of the CSRD is a significant step towards increasing transparency and strengthening corporate responsibility in the area of ESG.

What is the scope of the ESG reporting requirements?

The CSRD imposes several requirements for businesses to comply with:

Double materiality

Double materiality requires companies to disclose both their social and environmental impacts (impact materiality) and the potential financial impacts of these issues (financial materiality).

Mandatory and independent third-party verification

The European Union has mandated that sustainability reporting be subject to independent audits. Auditing standards are set by the European Commission. Companies can choose from a variety of audit firms that ensure consistent audit quality across the EU.

Mandatory reporting on Scope 3

Companies are required to disclose indirect Scope 3 greenhouse gas emissions covering their entire value chain under the GHG Protocol. Until now, this scope was voluntary. What is a Scope 3 carbon footprint? You can find out by reading this article.

Alignment with existing policies

The CSRD is aligned with existing EU sustainability policies, such as the SFDR and the Taxonomy Regulation. It also recognizes international reporting standards such as TCFD and GRI.

Reporting in electronic format

CSRD reports must be submitted in an electronic format. It can be in XHTML format or in a format that complies with the European Single Electronic Format (ESEF) regulations and the EU Sustainability Taxonomy.

Targets and reporting on progress

Companies are required to carefully identify, set, and report in detail specific GHG reduction targets, which includes meticulously identifying measures and strategies to minimize negative environmental impacts.

What are the risks for businesses for failing to report CSRD?

Failure to report non-financial data by the CSRD may result in financial penalties and legal sanctions. Their amount will most likely depend on various factors (e.g., size of the company, degree of violation, or repeated violations of the directive’s assumptions); in Poland, we will learn the exact sanctions within 18 months of the CSRD coming into force.

Non-financial data will be treated in the same way as financial statements – they will be an integral part of company reporting, which is why it is so important to approach the non-financial reporting process seriously and with full commitment. Importantly – so-called greenwashing is also to be subject to penalties.

The consequences of ineffective ESG reporting

- Companies that fail to comply with CSRD requirements may face significant difficulties in maintaining a competitive position in the market.

- The lack of a report may result in reduced investor inquiries, less interest, and difficulties in raising funds for business development from financial institutions.

- It can also lead to a loss of trust from key stakeholders (business partners, the local employee community, or suppliers) and unfavorable PR in business decisions.

- Companies reporting ESG scrupulously have the opportunity to become market leaders. In the absence of such a report, the company is shutting out of growth.

Plan Be Eco ensures CSRD-compliant tool

To be fully prepared, companies should start collecting data now. Plan Be Eco offers support in preparing for the new regulations. Despite limited time to implement them, our simple carbon footprint reporting tool will help you meet your obligations quickly and in compliance. The Plan Be Eco tool ensures that the report complies with the GHG Protocol and all the EU regulations.

Plan Be Eco not only offers a tool for carbon footprint reporting but also becomes a partner in green transformation. Unlike other platforms, Plan Be Eco provides accurate calculations of GHG emissions in all 3 scopes and was created by specialists for corporate sustainability reporting. If more ESG regulations are introduced, the developers can immediately implement them into the tool, ensuring that carbon footprint calculations comply with the latest standards.

Let’s team up and find out how we can help you in ESG reporting.

Entrepreneur, don’t wait, start now and ensure your company is prepared for the upcoming changes dictated by sustainability. As a first step, calculate your carbon footprint with us.